Special Situation Arbitrage Opportunity

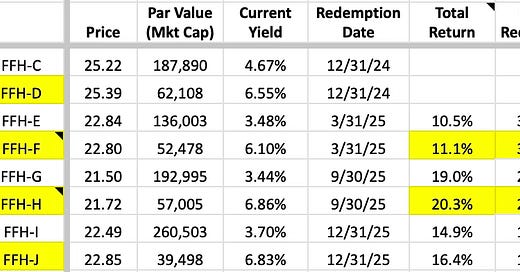

A hidden series of securities on a very high-quality company that I believe have been mispriced, and a recent announcement provides clarity on when this will get worked out, at nice potential IRR's

Saber’s portfolio is constructed using three different types of investments (I recently wrote a note to Saber clients that describe these categories, which I’ll publish here in an upcoming post). One of those categories contains special situations, including small liquidations, mutual holding company thrift conversions, and arbitrage opportunities to name a few. These types of stocks often get mispriced due to either forced selling or because they are small/hidden/neglected.

This idea falls into the latter group. There isn’t tremendous upside to most of these situations, but they are classic “base hits”, which I tend to favor, especially when they offer potential profits on a pre-defined time horizon, offering returns that might be uncorrelated to the broad market.

Today’s post offers a mini case study into the inefficiency that still exists in small corners of the stock market, as well as a special situation on a series of neglected securities of a very high-quality well-known company.