Notes on Credit Acceptance Corp (CACC)

I recently made a list of a few shareholder letters I want to read, and one that I completed a few days ago was Credit Acceptance Corp (CACC).

(I am thinking about putting more of these “scratch notes” up as posts. If this is interesting to readers, please let me know. Often times, I read about a company and don’t end up coming to a solid conclusion. I have many pages of notes on companies that I don’t ever discuss, simply because the information might not be actionable currently. But if these types of notes are worth reading, then I’ll begin putting up more of them.)

Credit Acceptance Corp makes used-car loans to subprime borrowers. CACC has a different model than most used-car lenders. Instead of the typical subprime auto-lending arrangement where the dealer originates the loan and the lender buys the loan at a slight discount, CACC partners with the dealer by paying an up-front “advance” and then splitting the cash flows with the dealer after CACC recoups the advance plus some profit. The advance typically covers the dealer’s COGS and provides a slight profit, and CACC has a low risk position as it gets 100% of the loan cash flow until its advance is paid back. What’s left over gets split between CACC and the dealer. The bottom line is that the dealer gets less money up front, but has more potential upside from the loan payments if the loan performs well.

The model works like this (these are just general assumptions and round numbers to illustrate their model): Let’s say a used-car dealer prices a car at $10,000. Let's say the dealer paid $8,000 for that car. The dealer finds a buyer willing to pay $10,000, but the buyer doesn’t have $10,000 in cash, has terrible credit, and can’t find conventional financing. CACC is willing to write this loan (CACC accepts virtually 100% of their loans). The buyer might pay $2,000 down, and CACC might send an advance to the dealer of around $7,000. So the dealer gets $9,000 up-front ($2,000 from the buyer and $7,000 from CACC). The dealer now has no risk, since it has received $9,000 for a car that cost it $8,000, and although the profit might be lower than if it got the full $10,000 retail value in cash, the dealer can make more money if the loan performs well. The $8,000 loan might carry an interest rate of 25% for a 4 year term, which is about $265 per month.

As the payments begin coming in, CACC gets 100% of the cash flow from the loan ($265 per month) until it gets its $7,000 advance paid back plus some profit (usually around 130% of the advance rate). Once this threshold is hit, if the loan is still performing, CACC continues to service the loan for around a 20% servicing fee, and the dealer keeps the other 80% of the cash flow as long as the payments keep coming in.

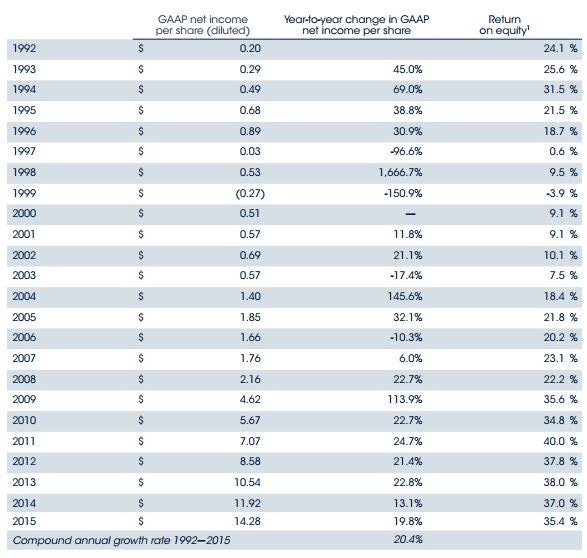

CACC has perfected this model and has achieved significant growth over time by steadily signing up more and more dealers. The result is a compounding machine:

But the conditions are always competitive in this business, and currently, lending terms are very loose and competition is brutal.