"A truly great business must have an enduring “moat” that protects excellent returns on invested capital."

–Warren Buffett, 2007 Shareholder Letter

During recent calls with Saber Capital clients, numerous questions related to quality and return on capital have come up, and I thought it would be good to review some recent posts.

For more details, I wrote a series on the topic of Returns on Incremental Capital and how to calculate and think about ROIC and value creation:

Part 1: Compounders and Cheap Stocks

Reinvestment Moats vs Legacy Moats (guest post from Connor Leonard)

First, a post that discusses Buffett's 2007 letter. In this letter, Buffett groups businesses into three general categories based on their ROIC profile, and explains the differences between those three categories.

Category #1—High ROIC Businesses with Low Capital Requirements

The best businesses are the ones that can grow without requiring any capital. This means owners get the growth while simultaneously putting each year’s earnings in their pocket as a dividend. I think many people underestimate the value of companies in this category because the compounding formula here is FCF yield plus growth (e.g. a company trading at 20 P/FCF (5% FCF yield) that can grow at 8% without needing to retain any earnings can compound value for owners at 13% (owners get the 5% in the form of a dividend or buyback and also get the 8% growth). Most companies that grow 8% have to retain some or all of those earnings, leading to a total compounding rate that is much closer to the growth rate.

Long-term competitive advantage in a stable industry is what we seek in a business. If that comes with rapid organic growth, great. But even without organic growth, such a business is rewarding. We will simply take the lush earnings of the business and use them to buy similar businesses elsewhere. There’s no rule that you have to invest money where you’ve earned it. Indeed, it’s often a mistake to do so: Truly great businesses, earning huge returns on tangible assets, can’t for any extended period reinvest a large portion of their earnings internally at high rates of return.

Let’s look at the prototype of a dream business, our own See’s Candy. The boxed-chocolates industry in which it operates is unexciting: Per-capita consumption in the U.S. is extremely low and doesn’t grow. Many once-important brands have disappeared, and only three companies have earned more than token profits over the last forty years. Indeed, I believe that See’s, though it obtains the bulk of its revenues from only a few states, accounts for nearly half of the entire industry’s earnings.

At See’s, annual sales were 16 million pounds of candy when Blue Chip Stamps purchased the company in 1972. (Charlie and I controlled Blue Chip at the time and later merged it into Berkshire.) Last year See’s sold 31 million pounds, a growth rate of only 2% annually. Yet its durable competitive advantage, built by the See’s family over a 50-year period, and strengthened subsequently by Chuck Huggins and Brad Kinstler, has produced extraordinary results for Berkshire.

Buffett then talks about the return on incremental capital and how he thinks about ROIC:

We bought See’s for $25 million when its sales were $30 million and pre-tax earnings were less than $5 million. The capital then required to conduct the business was $8 million. (Modest seasonal debt was also needed for a few months each year.) Consequently, the company was earning 60% pre-tax on invested capital. Two factors helped to minimize the funds required for operations. First, the product was sold for cash, and that eliminated accounts receivable. Second, the production and distribution cycle was short, which minimized inventories.

Last year See’s sales were $383 million, and pre-tax profits were $82 million. The capital now required to run the business is $40 million. This means we have had to reinvest only $32 million since 1972 to handle the modest physical growth – and somewhat immodest financial growth – of the business. In the meantime pre-tax earnings have totaled $1.35 billion. All of that, except for the $32 million, has been sent to Berkshire (or, in the early years, to Blue Chip). After paying corporate taxes on the profits, we have used the rest to buy other attractive businesses. Just as Adam and Eve kick-started an activity that led to six billion humans, See’s has given birth to multiple new streams of cash for us. (The biblical command to “be fruitful and multiply” is one we take seriously at Berkshire.)

I used this general back of the envelope math when thinking about return on capital (see this post for details on how I think about calculating incremental ROIC). It’s helpful to know roughly how much capital a business requires, how much of its earnings it can retain and reinvest, and what the returns from those investments will look like going forward. So See’s invested an incremental $32 million over the life of the business which produced an additional $1.35 billion of aggregate profits over that time, an astronomically high return on capital. Obviously, See’s is a “capital light business” and the ROIC is high because the denominator is low. See’s couldn’t reinvest that cash flow at high rates of return, so it had to ship the cash to Omaha for Buffett to reinvest elsewhere.

Category #2—Businesses that Require Capital to Grow; Produce Adequate Returns on that Capital

If the best business is one that can grow without needing capital to fund the growth, the second best company is one that needs capital to grow but that earns a good return on that capital (leading to a growth rate that creates value for owners). Using the example above, a company that can grow at 8% and needs half of that 5% earnings yield to grow will compound at 10.5% (still a nice long term rate of overall growth). If such a company is bought at a low price, the third engine (P/E multiple expansion) could lead this to be a successful investment. This is a good business because half the earnings are invested at a 16% ROIC (which produces 8% growth since half of the earnings are invested). This company will create value at that rate of ROIC, and the other 2.5% (the other half of the earnings) can be sent back as a dividend or buyback.

Companies like See’s produce huge returns on the small amount of capital that it previously invested. These are rare businesses that can grow their earning power without capital investment. In See’s case, this was largely done through pricing power. But See’s is a rare business, and as Buffett points out, companies that can reinvest capital at high rates of return are still attractive businesses to own:

There aren’t many See’s in Corporate America. Typically, companies that increase their earnings from $5 million to $82 million require, say, $400 million or so of capital investment to finance their growth. That’s because growing businesses have both working capital needs that increase in proportion to sales growth and significant requirements for fixed asset investments.

A company that needs large increases in capital to engender its growth may well prove to be a satisfactory investment. There is, to follow through on our example, nothing shabby about earning $82 million pre-tax on $400 million of net tangible assets. But that equation for the owner is vastly different from the See’s situation. It’s far better to have an ever-increasing stream of earnings with virtually no major capital requirements. Ask Microsoft or Google.

One example of good, but far from sensational, business economics is our own FlightSafety. This company delivers benefits to its customers that are the equal of those delivered by any business that I know of. It also possesses a durable competitive advantage: Going to any other flight-training provider than the best is like taking the low bid on a surgical procedure.

Nevertheless, this business requires a significant reinvestment of earnings if it is to grow. When we purchased FlightSafety in 1996, its pre-tax operating earnings were $111 million, and its net investment in fixed assets was $570 million. Since our purchase, depreciation charges have totaled $923 million. But capital expenditures have totaled $1.635 billion, most of that for simulators to match the new airplane models that are constantly being introduced. (A simulator can cost us more than $12 million, and we have 273 of them.) Our fixed assets, after depreciation, now amount to $1.079 billion. Pre-tax operating earnings in 2007 were $270 million, a gain of $159 million since 1996. That gain gave us a good, but far from See’s-like, return on our incremental investment of $509 million.

Consequently, if measured only by economic returns, FlightSafety is an excellent but not extraordinary business. Its put-up-more-to-earn-more experience is that faced by most corporations. For example, our large investment in regulated utilities falls squarely in this category. We will earn considerably more money in this business ten years from now, but we will invest many billions to make it.

Category #3—Businesses that Require Capital but Generates Low Returns

Here he uses the often-cited airline business as one that requires a lot of capital but can’t generate a decent return on that capital:

Now let’s move to the gruesome. The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines. Here a durable competitive advantage has proven elusive ever since the days of the Wright Brothers. Indeed, if a farsighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.

The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it. And I, to my shame, participated in this foolishness when I had Berkshire buy U.S. Air preferred stock in 1989. As the ink was drying on our check, the company went into a tailspin, and before long our preferred dividend was no longer being paid. But we then got very lucky. In one of the recurrent, but always misguided, bursts of optimism for airlines, we were actually able to sell our shares in 1998 for a hefty gain. In the decade following our sale, the company went bankrupt. Twice.

He sums it up by using a savings account analogy:

To sum up, think of three types of “savings accounts.” The great one pays an extraordinarily high interest rate that will rise as the years pass. The good one pays an attractive rate of interest that will be earned also on deposits that are added. Finally, the gruesome account both pays an inadequate interest rate and requires you to keep adding money at those disappointing returns.

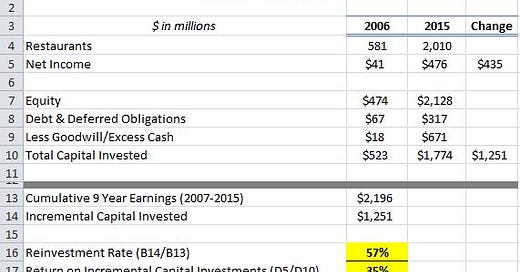

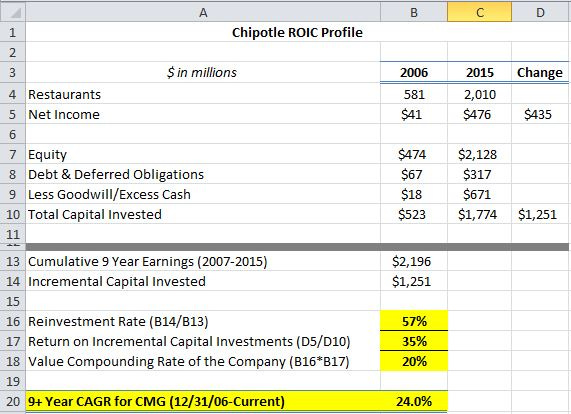

What’s interesting is that Buffett talks about See’s as the most attractive type of business in this example, and certainly a business that produces steadily rising cash flow on a very low capital base is a great business. But a business that has the ability to retain and reinvest a large portion of its cash flow at high rates of return is also a great business in my view. See’s is great because it produces cash flow without the need for capital investments, and it can still grow its earnings through pricing power. So this is truly an exceptional business. Moody’s might be a similar business—the ability to grow without new capital, which in essence means an infinitely high return on capital. But those companies are incredibly rare birds. The next best business (and depending on the rate of return maybe even a better business) is one that can reinvest lots of capital at very high rates. This is where the compounding machine kicks into gear. I used the example of CMG in the previous post mentioned above. The company had incredible attractive restaurant-level economics: it could set up a new location for around $800,000 and in the first year that restaurant would generate over $2 million in sales and $600,000 in cash flow, or a 75% return on capital. Combine these high returns, with a long runway to put lots of capital to work (it was able to maintain these returns while growing from 500 stores to over 2000), and you have a formula for a compounding machine of great proportions. CMG invested $1.25 billion during the decade between 2006-2015, an investment that led to $435 million of incremental earnings, an outstanding 35% return on incremental capital:

These high returns on capital led to steadily rising intrinsic value for the business over that time. In these types of businesses, requiring a lot of capital is a good thing (or at least certainly not a bad thing if it can be reinvested at 75% cash on cash returns). Another example is Markel, an insurance business that is obviously much more capital intensive than See’s Candy, but yet has been an incredible compounding machine over the years thanks to its ability to retain its earnings and reinvest them back into the business at high rates of returns. The result of these high returns on incremental capital has been a steadily rising intrinsic value per share (and stock price):

Buffett himself described this type of business in an earlier letter (1992) when he said:

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

So we might think two categories of great businesses:

Those that can retain and reinvest most/all of its earnings at high rates of returns

Those that don’t have any reinvestment ability within the business but can still grow earning power with little to no incremental capital

In a durable business with predictable cash flows, the latter category leads to a compounding effect that sees earning power per share impacted by the absolute growth of earnings as well as the steadily shrinking share count. Both types of businesses are rare birds, but I would say the second category (the See’s or Moody’s type businesses that can produce sizable free cash flow using very little capital and can grow its earnings through pricing power) is exceedingly rare, but probably the most valuable.

Thanks for reading!

John Huber is the founder of Saber Capital Management, LLC. Saber manages separate accounts for clients and also is the general partner and manager of an investment fund modeled after the original Buffett partnerships.

John can be reached at john@sabercapitalmgt.com.

John, I'm just searching through Bing for your old posts and I'm learning an incredible amount so thank you for what you do here. I'll admit I'm clueless about this stuff (I'm teaching myself about all of this) so forgive the following question if it's a bit simplistic:

"Using the example above, a company that can grow at 8% and needs half of that 5% earnings yield to grow will compound at 10.5% (still a nice long term rate of overall growth). If such a company is bought at a low price, the third engine (P/E multiple expansion) could lead this to be a successful investment. This is a good business because half the earnings are invested at a 16% ROIC (which produces 8% growth since half of the earnings are invested). This company will create value at that rate of ROIC, and the other 2.5% (the other half of the earnings) can be sent back as a dividend or buyback."

Do you just double the 8% sales growth rate to figure out the ROIC of the company in this example? Is this the quickhand way you figure out ROIC for a company you stumble onto out in the wild?